Why Amazon Can’t Be an Afterthought in 2026: The Multichannel Reality for Growing Brands

Ten years ago, most prestige and growth brands treated Amazon as a supplementary channel, something to turn on after prioritizing Sephora, Ulta, department stores, or DTC. Today, Amazon sits at the center of the P&L as a core revenue engine and strategic pillar; and brands that under‑invest in the channel are missing out on outsized growth, insight, and brand‑building opportunities.

Over the last few years, that shift has come into sharp focus in conversations with Envision Horizons clients and partners. Senior leaders are now talking about Amazon in the language of hero campaigns, unit economics, and board‑level priorities, not just catalog management and “replenishment.”

The Amazon Mindset Shift

On paper, Amazon’s growth story in 2025 looked straightforward: net sales and marketplace demand climbed, even as costs rose across the P&L. Rising fees, logistics & labor inflation, and tariff shocks made it impossible to “fake” contribution profit; brands that did not really understand their unit economics watched their marketplace growth quietly erode margin.

The problem is, that reality clashes with an older mindset that Amazon is a “plug and play” platform. Many brands still expect a seamless launch and instead hit a wall of idiosyncrasies: retail‑readiness requirements, inventory constraints, review-building, and the need to build relevance at the bottom of the funnel before chasing awareness. When those basics are skipped and brands simply “turn on ads,” tentpoles like Prime Day and Cyber Week become expensive vanity metric boosts rather than profitable growth moments. Under those conditions, Amazon isn’t just a place to sell; it’s where your brand shows up under pressure.

Full‑Funnel Reality: Your Amazon Presence Is Your Brand

Amazon may have once sat at the edge of the marketing deck. Now sits in the middle of the brand funnel. In a recent On The Horizons interview, Envision Horizons client Lil Fazio, SVP of Marketing at Elemis US, put it simply: “creative is targeting” on Amazon. If your hero campaign does not show up coherently on your PDPs, Brand Store, and retail media units, the scent trail goes cold right where most product search now begins.

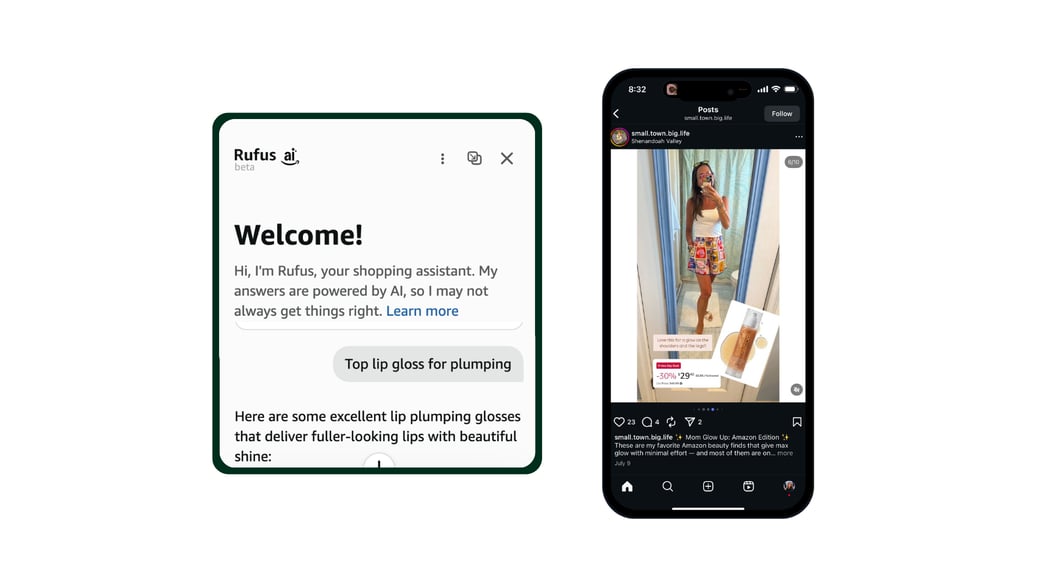

However, its also important to note that shoppers don’t just live inside Amazon, they move in and out of channels all day. The mechanics of discovery on the platform are changing. AI‑enabled shopping modes and assistants like Rufus are shifting behavior from simple keyword search toward intent‑driven, conversational journeys, which rely heavily on structured catalog data, FAQs, reviews, and on‑page content. Brands that treat Amazon copy, imagery, and video as generic ecommerce assets are opting out of that discovery layer. Brands that invest in complete, high‑quality content and refresh it in line with search trends gain an edge.

Amazon’s Role in Connected Commerce

None of this means Amazon should replace DTC, retail, or social as a focus.

The shopper, however, does not see channels the way organizations do. The shopper may first encounter a brand through an influencer, a salon treatment, a TikTok review, an AI chatbot, or a department store counter, etc. They may then head to Amazon to validate, compare, and decide whether and where to buy.

Client conversations make this journey concrete. Lil Fazio describes how millions of Elemis spa treatments occur each year aboard cruise ships; when those guests return to land and look to repurchase, they expect to find the brand wherever it is most convenient, including Amazon. Envision Horizons client Dawn Hilarczyk, COO of heritage luxury skincare brand Borghese, takes a similar stance: she doesn’t mind whether the customer shops at Neiman Marcus, Macy’s, the brand’s own site, or Amazon, so long as the experience feels consistent and accessible. In her view, convenience is now a core part of what luxury means.

So what does it actually look like when brands treat Amazon like a core part of the business rather than a side hustle?

How Sophisticated Brands are Using Amazon as a Core Channel

What distinguishes brands that treat Amazon as a core channel in 2026 is less their platform presence and more how intentionally they operate on the platform and connect it to the rest of their business.

- Shopper‑first, not channel‑first

At Envision Horizons, we often challenge our clients to drop the mental split between “DTC shopper” and “Amazon shopper.” A loyal website customer who searches a brand or category on Amazon and fails to find a compelling, retail‑ready presence is still a lost sale (even if they had purchased elsewhere before). Treating the shopper as a single person across channels changes decisions about assortment, content, and measurement. - Channel roles and merchandising strategy

Both Lil and Dawn emphasize protecting brand DNA while adapting to channel realities. That can mean keeping the core brand story and hero products consistent, then tailoring elements like pack sizes, bundles, or sets to Amazon’s more budget‑conscious segments, while using different configurations in DTC or specialty retail. This helps maintain positioning while meeting distinct shopper expectations in each environment. - Gaining control through 1P to 3P transitions

Dawn’s experience at Borghese illustrates why simply “being on Amazon” is not enough. Under a traditional wholesale model, the brand had limited control over content, pricing, and inventory, and discovered that its most iconic product was not even among its top SKUs on the platform. Moving from Vendor to Seller Central unlocked the ability to manage listings in real time, align pricing strategy, and use Amazon data to inform broader decisions…all prerequisites for treating the marketplace as a core growth driver. - Retail media as part of the P&L

Envision Horizons’ Media Director, James Corley, highlights how successful brands use a crawl‑walk‑run approach: first winning on core search terms and Sponsored Products, then layering Sponsored Brands, video, and conquesting, and finally adding DSP and, where appropriate, streaming TV as accelerants. In this model, retail media is integrated into the profit equation alongside fees, pricing, and promotions, rather than evaluated as a separate “ad budget” disconnected from the underlying economics. - Creators, AI, and measurement as force multipliers

On the acquisition side, Amazon’s Creator Connections and affiliate programs have evolved into performance levers, with Envision Horizons clients seeing triple‑digit year‑over‑year affiliate growth when they lean into creators during key events. On the measurement side, tools like Amazon Marketing Cloud and clean‑room environments are making it easier to understand path‑to‑purchase, incrementality, and audience overlap, especially when paired with first‑party data from DTC and retail. The brands that benefit most are those that treat these capabilities as decision systems.

What This Year Demands From 2026 Strategies

The themes that emerged in 2025 make it clear that the platform isn’t standing still. Amazon’s own growth remained robust, but the combination of fee shifts, logistics costs, and tariff pressures turned the marketplace into a stress test for margin management. Retail media became a decisive factor in who actually captured profit, not just top‑line sales, and creator programs evolved from experiments into true acquisition engines. AI‑powered tools reshaped both how shoppers discover products and how brands plan and measure spend.

Across those shifts, one pattern stood out: 2025 rewarded brands that treated Amazon as a real business. Those operators knew their unit economics, approached media and promotion as part of the P&L, built content and creative systems that could keep up with AI‑driven discovery, and used tentpole events to build true value. Brands that were present but under‑invested, by contrast, captured only a fraction of the channel’s potential and often learned hard margin lessons during the year’s biggest events.

What “Not an Afterthought” Looks Like in Practice for 2026

For growing brands, shifting Amazon from side channel to core channel in 2026 doesn’t mean abandoning DTC or retail. In practice, this looks like:

- Designing Amazon into the financial model from day one: fully loaded unit economics, realistic fees and media, and a clear role in the P&L.

- A cohesive branded presence on Amazon: Brand campaigns and hero products that show up coherently in PDPs, Brand Store, and retail media units, not a disconnected e-com experience.

- Treating Amazon as part of the customer journey, not just a purchase endpoint: where clients repurchase, TV or TikTok audiences validate you, and retail customers compare options.

- Educating the C‑suite and board so Amazon strategy isn’t left to a single channel manager; leaders need to understand the trade‑offs between 1P and 3P, retail relationships, and channel roles.

- Using Amazon insights to inform broader multichannel decisions: product development, pricing, bundles, and even where to test new marketplaces like Ulta.

In 2026, the brands that grow fastest and most profitably will be the ones that accept the multichannel reality, stop treating Amazon as an optional add‑on, and build it into the heart of how they acquire, serve, and retain customers across every touchpoint.

About Envision Horizons

Envision Horizons is a global marketplace growth agency that empowers premium brands to dominate multi-channel commerce. We specialize in building awareness, capturing market share, and driving profitability across Amazon, Walmart, and other major retail media networks.

Our expert team delivers data-driven strategy, execution, and optimization for brands ready to scale their marketplace presence through our comprehensive service offerings:

- Marketplace Advertising - Amazon Sponsored Products, Brands, Display & DSP; Walmart Connect; Target Roundel

- SEO & Creative Optimization - Marketplace-specific content and conversion strategies

- Commerce Operations - Brand management, inventory optimization, fulfillment, and account health

- Affiliate Marketing Services

Powered by our proprietary myHorizons intelligence platform and backed by Advanced Amazon Partner status, we deliver measurable results for leading brands worldwide.

Ready to transform your marketplace performance into sustainable growth? Connect with the Envision Horizons team to explore how we can help you make Amazon a core pillar of your 2026 strategy.