A Guide to Amazon Seller Bookkeeping

If you sell on Amazon, the bookkeeping for it can be pretty complex compared to a typical business. For starters, you buy your stock months ahead of time and then you get paid a couple of weeks after you actually sell it. Tying all that together can be tricky!

Our guide will cover all the basics, from defining bookkeeping to finding the best Amazon FBA accounting software. But first, a little background info on our company.

We’re not like most accounting firms. For starters, we actually specialize in bookkeeping for Amazon sellers, so we’re familiar with all the common pain points among merchants. Second, we operate on a virtual business model, meaning we serve clients all over the U.S. (and even the world!). Third, we know how daunting the topic of bookkeeping can be, which is why we avoid jargon and instead use a casual, down-to-earth communication style that makes for easier understanding. After reading this introductory guide, you’ll find that bookkeeping isn’t nearly as intimidating as you thought it was.

Here’s what we’ll go over:

- What is Amazon seller bookkeeping?

- Why are accounting and bookkeeping important for Amazon seller businesses?

- What are the top benefits for Amazon sellers?

- What makes Amazon bookkeeping different from most other businesses?

- How to do accounting for an Amazon seller business

- Amazon bookkeeping key takeaways

What Is Amazon Seller Bookkeeping?

Simply put, Amazon seller bookkeeping is the recording and storing of a merchant’s day-to-day financial transactions. Common financial transactions include sales, purchases, shipping costs, money paid to suppliers, loan payments, and advertising spend. In the next point, we’ll explain why proper bookkeeping is essential to running a business.

Why Are Accounting and Bookkeeping Important for Amazon Seller Businesses?

There are multiple reasons why accounting and bookkeeping are important for Amazon seller businesses, but we’ll start with one of the most important: tracking your financial activities allows you to evaluate how your business is performing over time.

Do you know, for example, how much you’ve made in profit? Not how much revenue you generated in sales, but how much you earned in profit.

Remember: profit is the money left over after all other expenses have been taken out. With proper bookkeeping, you can easily calculate your profits by subtracting all your expenses from your total revenue. Without this data, it’s difficult to assess the health and long-term viability of your business, as you’ll have no way of knowing how much (if any!) profit you are making.

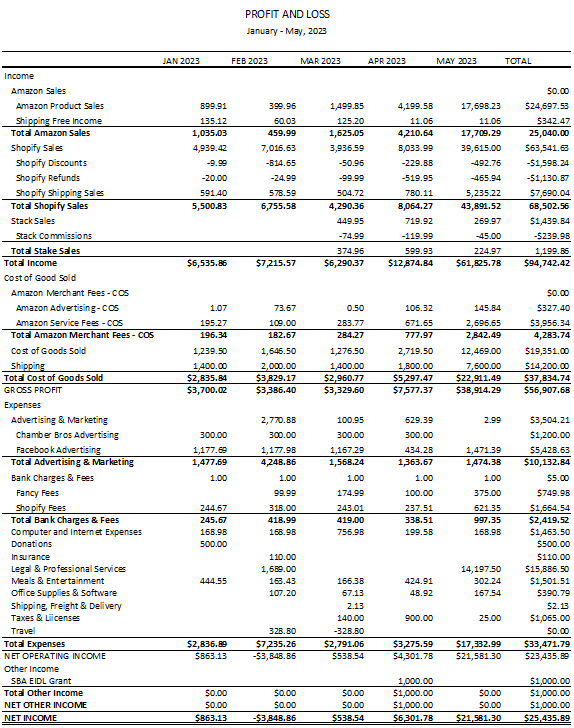

Below is an example of a profit and loss (P&L) statement that we compiled for one of our Amazon seller clients:

While you can get a general picture of sales and even and idea of gross profit from dashboard programs like SellerBoard or even Amazon itself, without the full accounting picture you still don’t know if you are really profitable and how much cash you are going to have left. You also will have no idea how much to pay in taxes unless you actually do proper bookkeeping from a system like that.

A detailed income statement report like this gives you an overview of how much you’re spending in comparison to how much you’re earning. The goal, of course, is to earn more than you spend.

Another reason accounting and bookkeeping are important for Amazon seller businesses is because it allows you to spot discrepancies as they occur. For example, let’s say that your advertising costs are way higher than they should be. Upon further investigation, you discover that the advertising agency you use accidentally double-charged you. This error may have gone unnoticed if you hadn’t reviewed your financials.

And then there’s the tax side of things, of course. When you file your taxes, you’ll need to report your income and expenses, but if they’re not classified correctly, you may be missing out on huge savings or may even incur a penalty. You’ll also want to have your financial records on hand in the event that you are audited by the IRS.

What Are the Top Benefits for Amazon Sellers?

Bookkeeping comes with a couple of key benefits that most Amazon sellers don’t even think about.

For one, if you ever decide to apply for a business loan, you’ll need to provide the creditor with various financial information. This is easy to do if your books are accurate and up-to-date. Not so much if you haven’t been tracking this information or if your records are faulty.

Two, if you ever decide to sell your business, the buyer will want to review your financials. Again, not a problem if your books are properly maintained on an accrual basis, but quite the nightmare if not and very likely you’re leaving money on the table at best and not even able to sell at all at worst.

What Makes Amazon Bookkeeping Different From Most Other Businesses?

1) Amazon bookkeeping is best done on an accrual basis, unlike most other small businesses that run on a cash basis.

The problem with cash basis accounting is you may buy inventory weeks or months before you sell it, and then you don’t get paid for it until two weeks or more after it’s sold and shipped. So with cash basis accounting (income and expenses are posted when they happen) you can have months that look very profitable (because you bought no inventory) and months that look very bad because you bought a ton of new merchandise.

Accrual bookkeeping balances that out by matching your sales with when your product gets shipped out. This means we record the total amount you sold in a month even when you didn’t get paid yet and match it with the cost of the items you sold, even though you may have bought them a long time ago. This way, you can see for each product you sell if you are making a profit or not!

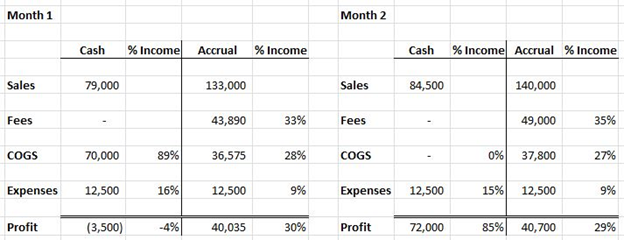

To see how this can affect things in the real world, here is a side-by-side example of the same business showing two months of results on both a cash basis and an accrual basis:

In month one, on the cash side, there is a big inventory purchase which causes the whole month to look like a loss. In month two, on the cash side, there is no inventory bought so the business looks crazy profitable. But neither month is really a good reflection of what is happening.

On the accrual side, the sales look higher because we include the total sales before Amazon fees, we show the fees and the COGS (cost of goods sold) is tied directly to what products shipped in that month, not what was bought. So the month has a nice profit. Month two looks similar but you can see Amazon fees and COGS increase a bit which is a pretty common fluctuation month to month. Without doing it on accrual though you can’t tell what’s going on with the business or get a good apples to apples comparison on your month over month results.

2) With an Amazon business it is very important to track COGS correctly and use landed cost whenever possible. As you can see above, COGS is typically one of the single biggest expenses for an Amazon seller. In order to get a true cost of selling the products, you want to include both the cost of the product itself as well as any costs incurred to get it to the Amazon warehouse (things like shipping, duties, fees, etc).

The goal is to have the per unit cost be as close to the actual “all in” cost of selling as possible since this directly affects the profitability of the business. If you only have a few products, this is easy to track with a spreadsheet. As you start to stock more SKUs, you may want to migrate to inventory management software to help with this task and keep you on track.

3) If you have more than one sales channel, you want to make sure you are separating income and expenses by channel (Amazon US from Amazon UK, etc., and Amazon in general from Shopify, Wal-Mart, eBay, etc.). Although you may be selling the same products in various markets, you definitely will want to know which of those channels is producing the best return on that time.

You will want to track both sales, COGS and fees and any related channel specific expenses so you can compare. This may help you decide where to expand or where the effort may not be justified. Lumping it all together is the worst way to view this as it won’t tell you anything other than your total results and may in fact be hiding the fact that one channel is heavily subsidizing other channels or even covering up losses!

4) Consider tracking operating expenses (things you NEED to run the business) separately from overhead expenses that are legitimate business deductions but not required to run the business for when you are preparing to sell the business. The value of the business when you sell it is based on the Seller’s Discretionary Earnings (SDE) which is profits plus anything you spent on the business that wasn’t needed to actually produce the results you got. These would be things like meals, travel, continuing education, consulting, product samples, and any one-time costs.

If we know ahead of time you are considering selling, we can separate these two types of expenses right in your chart of accounts and that will let you see a running total of your twelve month SDE that will give you the basis for the value of your business. While this can be done after the fact, having it already broken out saves the time and gives you a month to month view of how much your business might sell for if you put it on the market.

How to Do Accounting For An Amazon Seller Business

There are two options for doing accounting for an Amazon seller business: you can either do it yourself or hire a professional to do it for you.

Let’s discuss the latter option first as it’s easier (and often cheaper, but more on that in a minute).

When you hire a professional bookkeeper, it takes all the stress and anxiety off your shoulders. You won’t need to worry about it being done, done on time, and done correctly. Plus, outsourcing this task allows you to focus on other aspects of your business that you likely find more enjoyable, such as product development and marketing.

Make no mistake about it: bookkeeping is not a skill you can pick up overnight. When you factor in how much time and effort you’ll spend learning how to do it on your own, you’ll find that it’s much cheaper to hire a professional. Besides, you may be pleasantly surprised by how affordable virtual bookkeeping services are. Our firm, for example, offers flat-rate month-to-month bookkeeping for Amazon sellers starting at $199/mo.

But hey, if you’re really a glutton for punishment and insist on doing it on your own, we’re not going to stop you. As previously mentioned, it’s not something you can learn overnight—much less in this short guide. We’ll therefore give you your very first homework assignment: read Amazon Seller Bookkeeping, written by CapForge founder and CEO Matt Remuzzi. In this book, he’ll walk you through how to set up and maintain your books for your Amazon business.

Get a FREE downloadable copy by entering your name and email here.

Another quick note before we move on, as we get asked this question a lot: we recommend using QuickBooks as your Amazon FBA accounting software. Why? Because it is the most popular bookkeeping program for small and medium sized businesses. Xero is a viable alternative if you live outside the U.S., as there are more Xero users in Australia and New Zealand along with a close number in the EU and other areas compared to QuickBooks.

Amazon Bookkeeping Key Takeaways

Now that you’ve made it to the end of this guide, let’s do a brief recap of the key takeaways:

- Bookkeeping for Amazon sellers is important because it allows you to monitor how your business is performing over time.

- Accurate and up-to-date bookkeeping allows you to catch discrepancies in a timely manner.

- Maintaining your financial records will come in handy come tax season, in the event you are audited, if you apply for a business loan, and if you decide to sell your business.

- You can either do your own bookkeeping or hire a professional service. For most Amazon sellers, it’s faster and cheaper to hire a professional service.

- Amazon bookkeeping is best done on an accrual basis.

- It is very important to track cost of goods sold (COGS) correctly.

- If you decide to do your own bookkeeping, make sure you separate income and expenses by channel. You should also consider tracking operating expenses separately from overhead expenses for when you are preparing to sell the business.

- The best Amazon FBA accounting software is QuickBooks (Xero is a viable alternative if you live outside the U.S.)

Got additional questions we didn’t cover in this guide? Contact us via email at info@capforge.com or give us a call at (858) 633-3573.

Matt Remuzzi started CapForge back in 2000 after being laid off from a venture backed firm as part of the dotcom bust happening at the time. He has a BA from UCSD and an MBA from SDSU. CapForge started out as a consulting business for small businesses and has never strayed far from those roots.In 2012 bookkeeping became the focus, with more accounting services added in each year including tax prep, payroll, coaching and advisory services, due diligence, and business exits all becoming part of the services offered. He continues to work on growing the business while the team runs the day to day operations and continues to ensure they are always providing five star quality and service to their clients.